Philippines imposes 12% tax on foreign digital services

MANILA, PHILIPPINES — Philippine President Ferdinand Marcos Jr. recently signed into law a measure imposing a 12% value-added tax (VAT) on foreign digital service providers. This move marks a significant step in the Philippines’ efforts to generate additional revenue and ensure fair competition for local businesses.

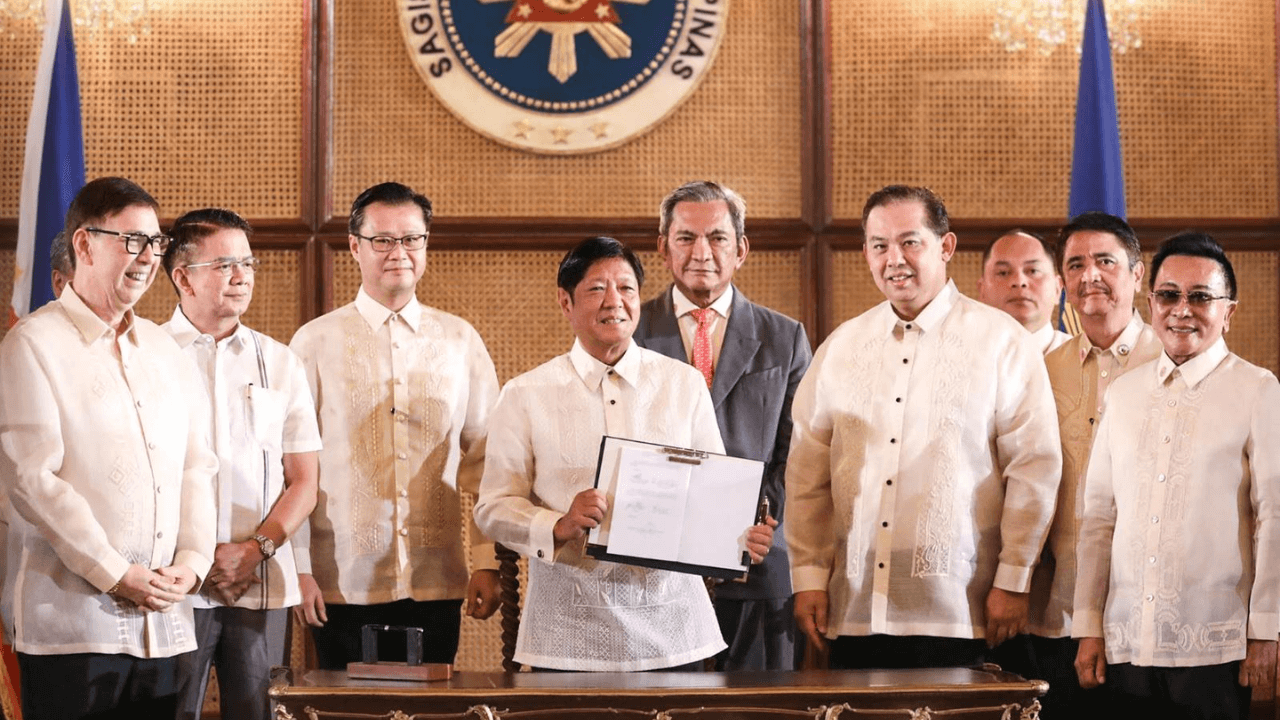

The legislation, known as Republic Act (RA) 12023, was signed during a ceremony at Malacañang Palace and targets major international platforms such as Netflix, Disney, and HBO.

SaaS and other digital services included

The law broadly defines digital services as any service delivered or subscribed over the internet or other electronic networks that require information technology. This encompasses:

- The supply of advertising space and related services for online advertisements

- Digital services provided in exchange for regular subscription fees

- Electronic or online services deliverable via IT infrastructure like the internet

These categories cover a wide range of income sources, including software licensing, database services, online telecommunications, e-learning (excluding public educators), streaming and downloadable media, mobile applications, and e-books and newspapers.

Software as a Service (SaaS) platforms and cloud-based software, hosting services, online advertising, dating memberships, online gaming, and search engine services are also included.

This comprehensive definition ensures that all relevant digital content is subject to the new VAT regulations.

Revenue boost for infrastructure and education

The administration views this measure as a priority, with projections from the Department of Finance estimating revenue generation between PHP80 billion (US$1.42 billion) and PHP145 billion (US$2.57 billion) from 2025 to 2028.

President Marcos highlighted that the anticipated revenue is earmarked for critical infrastructure projects, including the construction of 42,000 classrooms, over 6,000 rural health units, and 7,000 kilometers of farm-to-market roads.

Support for local creative industries

A unique aspect of RA 12023 is its provision to allocate 5% of the generated revenues to the local creative industry.

This initiative aims to support artists, filmmakers, and musicians by ensuring they benefit directly from the digital economy.

“It ensures that our creative talents are not just surviving in a competitive digital market, but will be allowed by fairness and progress,” Marcos emphasized, underscoring the law’s commitment to fostering fairness and progress in the competitive digital market.

Ensuring fair competition among providers

Senator Sherwin Gatchalian praised the law for addressing revenue losses by clarifying the tax obligations of non-resident digital service providers.

“We believe in the importance of creating an environment where our digital services providers, whether they are nonresident or local, operate under fair and square tax policies,” Gatchalian stated.

He emphasized that the law does not introduce a new tax but ensures that existing taxes are collected from foreign DSPs. This move is seen as leveling the playing field between local businesses and international digital platforms.

Strengthening tax compliance mechanisms

Finance Secretary Ralph Recto noted that this law corrects an imbalance in the current system that favors foreign DSPs over local businesses.

“By doing this, we foster fairness, competition, and inclusion in our tax system and marketplace. Whether you are a local entrepreneur or a global giant, everyone will play by the same rules,” he added.

The Bureau of Internal Revenue (BIR) will now have enhanced authority to enforce VAT compliance among foreign DSPs with annual sales exceeding PHP3 million (US$53,000).

Foreign DSPs are required to establish a representative office or agent in the Philippines to assist with compliance. Non-compliance may lead to temporary suspension of business operations.

The enactment of RA 12023 marks a pivotal moment in the Philippines’ digital economy landscape. It promotes equitable tax practices and supports national development goals. This legislation aligns with global trends, as countries like Singapore, Indonesia, and Malaysia have implemented similar digital service taxes to ensure fair competition and bolster national revenues.

Independent

Independent